Bjqthy Insights

Exploring diverse topics and the latest trends.

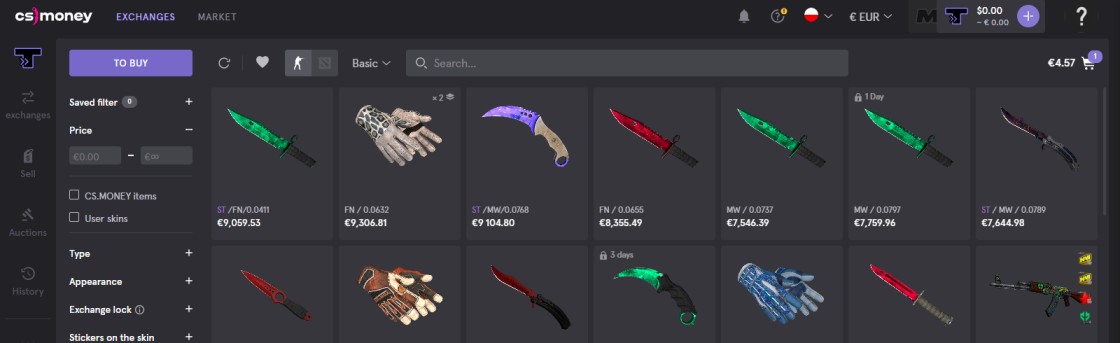

Trade Bots: BFFs or Just Overhyped Scripts?

Discover if trade bots are your new best friends or just overhyped scripts in this eye-opening blog post!

Are Trade Bots the Future of Automated Trading?

As the financial markets continue to evolve, trade bots are becoming an increasingly popular tool for investors seeking to optimize their trading strategies. These automated systems leverage algorithms to execute trades at lightning speed, reducing the emotional stress and decision fatigue that often accompanies manual trading. With advancements in machine learning and artificial intelligence, trade bots are becoming more sophisticated, adapting to market conditions in real-time. This evolution raises the question: are trade bots the future of automated trading?

Proponents argue that the ability to analyze vast amounts of data in seconds gives trade bots a significant edge over traditional trading methods. For instance, by processing historical data and current market trends, these bots can identify patterns and execute trades that might be missed by even the most experienced traders. However, it's essential to note that while trade bots can enhance trading efficiency, they are not without risks. Market volatility, technical failures, and the potential for over-optimization can lead to significant losses. Thus, while trade bots have the potential to shape the future of trading, investors must approach them with caution and a solid understanding of their functionalities.

As the gaming community continues to evolve, many players are exploring the potential benefits of automation in trading. For those curious about the role of technology in enhancing their gaming experience, check out my blog titled Trade Bots in CS2: Your New Best Friends or Just Fancy Scripts?, where I delve into the advantages and drawbacks of using trade bots in Counter-Strike 2.

The Pros and Cons of Using Trade Bots: Are They Worth It?

Trade bots have gained significant popularity in the financial markets due to their ability to execute trades automatically based on pre-set algorithms and strategies. One of the most notable advantages of using trade bots is their ability to operate 24/7, ensuring that opportunities are not missed while the trader sleeps. This constant vigilance can lead to increased profits and efficiency. Additionally, trade bots can process vast amounts of data quickly, allowing for rapid execution of trades that human traders might not be able to replicate. However, it is essential to remember that reliance on these bots can lead to overconfidence and reduced engagement in market analysis.

On the flip side, there are also several downsides to consider. One major con is the inherent risk of relying on automated systems that may not adapt well to sudden market changes or conditions. Trade bots are only as good as the strategies and algorithms they operate on; a poorly designed bot can result in significant losses. Furthermore, the use of trade bots introduces concerns regarding security and data privacy, as traders must share their accounts with third-party applications. In summary, while trade bots can offer advantages like efficiency and speed, they also come with risks that traders must carefully weigh to determine if they are truly worth it.

How Do Trade Bots Actually Work? A Deep Dive into Their Mechanics

Trade bots are automated software programs designed to execute trading orders on behalf of investors and traders in the financial markets. They leverage predefined algorithms and set parameters to analyze market trends, price movements, and trading signals. When certain criteria are met, these bots execute trades instantly, which not only enhances efficiency but also helps in minimizing emotional decision-making. Most trade bots utilize a combination of technical analysis indicators, real-time market data, and machine learning techniques to make informed decisions in the rapidly changing market environment.

Understanding how these bots operate involves delving into their underlying mechanics. Typically, a trade bot will follow a series of steps:

- Data Collection: Gathering real-time data from various markets and exchanges.

- Analysis: Applying algorithms to process data and identify potential trading opportunities based on historical patterns.

- Execution: Placing buy or sell orders based on the analysis.

- Monitoring: Continuously tracking market conditions to adjust strategies as needed.