Bjqthy Insights

Exploring diverse topics and the latest trends.

Term Life Insurance: Your Future's Safety Net in Disguise

Discover how term life insurance can be your hidden safeguard for the future—protecting loved ones and securing peace of mind!

Understanding Term Life Insurance: Key Benefits Explained

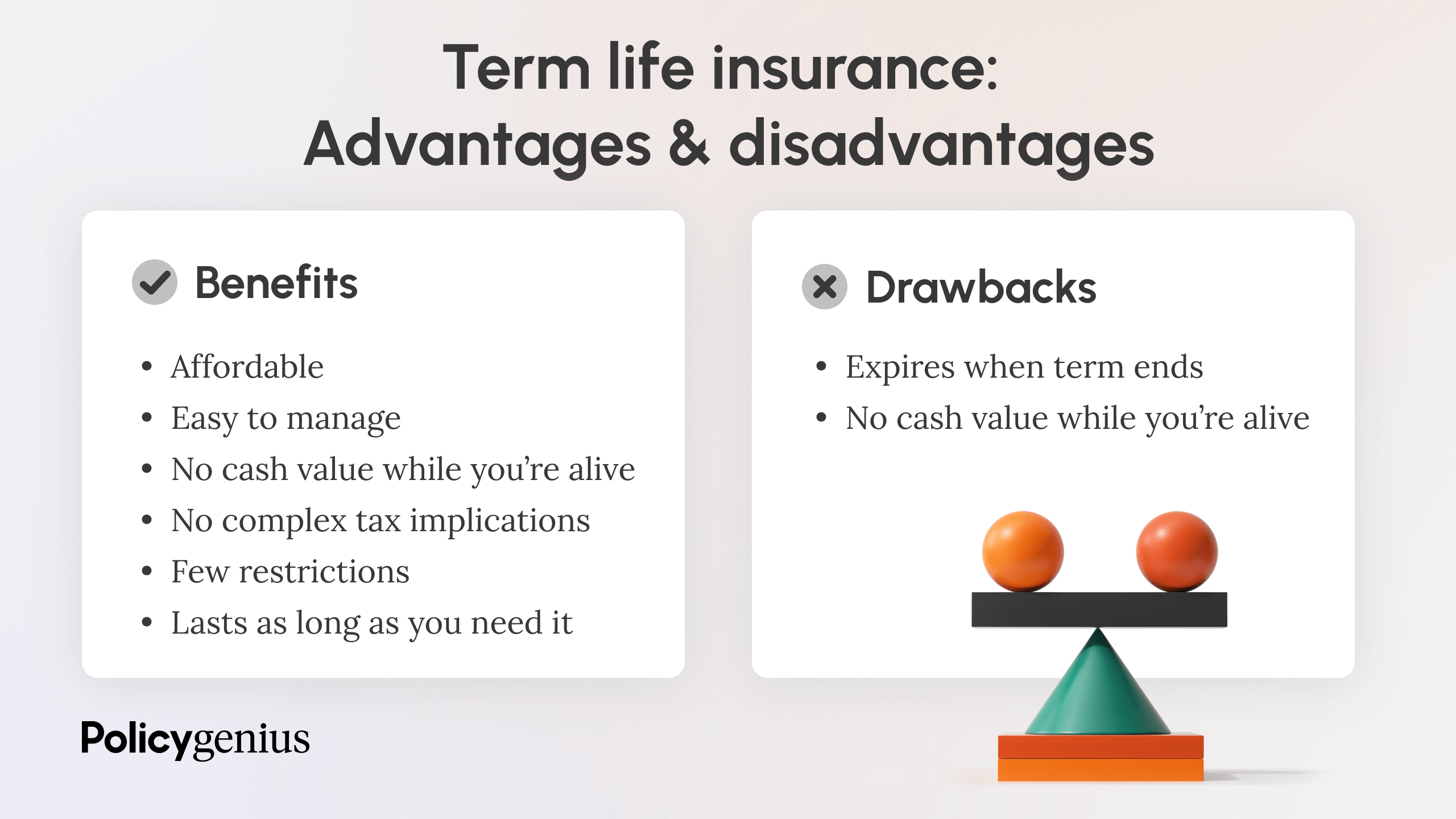

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. This insurance is designed to give you peace of mind, knowing that your loved ones are financially protected in case of your untimely demise during the policy term. One of the primary benefits of term life insurance is its affordability compared to whole life insurance. Because it only pays out if the insured passes away within the designated term, the premiums are generally much lower, making it a more accessible option for individuals and families who are looking to secure financial stability.

Another significant advantage of term life insurance is its straightforward nature. Unlike permanent life insurance policies that can be complex and involve cash value accumulation, term life insurance is easy to understand. You pay a fixed premium for a set amount of coverage for a specified duration. Additionally, it allows you to align the policy term with specific financial obligations, such as paying off a mortgage or funding your children's education. In summary, term life insurance is a practical choice for those seeking short-term financial protection without the heavy cost of permanent options.

Is Term Life Insurance Right for You? Factors to Consider

When considering whether term life insurance is right for you, it's essential to evaluate your financial obligations and personal circumstances. Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. This type of policy is ideal if you have dependents, such as children or a spouse, who rely on your income. Additionally, assess your outstanding debts, including a mortgage or student loans, as these can influence the amount of coverage you may need.

Another important factor to consider is your budget. Term life insurance is often more affordable than permanent life insurance, making it an appealing choice for many individuals. However, you should ensure that the premiums fit comfortably within your financial plan. Moreover, it's crucial to determine the length of coverage required—did you want the policy to last until your children are financially independent or until your mortgage is paid off? Taking the time to evaluate these elements will help you make an informed decision about your life insurance needs.

How to Choose the Best Term Life Insurance Policy for Your Needs

Choosing the best term life insurance policy to meet your financial needs requires careful consideration of several key factors. Start by evaluating your financial responsibilities, such as mortgage payments, educational expenses for your children, and general living costs. This will help you determine the amount of coverage necessary to adequately protect your loved ones in the event of your passing. Additionally, assess how long you will need this coverage based on your life goals; for instance, if you have young children, you might opt for a policy that lasts until they reach adulthood.

Next, it's crucial to compare different insurance providers and their term life insurance policies. Look into their financial stability, claim settlement ratios, and customer reviews. You can also consider the flexibility of the policies, including options for conversion to permanent life insurance in the future. Utilize a life insurance calculator to estimate premium costs based on your desired coverage amount and term length. Ultimately, selecting the right policy is about striking a balance between affordability and adequate protection for you and your family.